Navigating Healthcare Policies Across U.S. States: A Comprehensive Guide

|

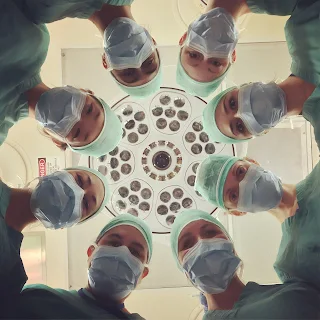

| Photo by National Cancer Institute on Unsplash |

Healthcare in the United States is a complex and often confusing subject. With different policies, regulations, and insurance options varying from state to state, it's easy to feel overwhelmed. But don't worry, we've got you covered. This comprehensive guide aims to equip you with the knowledge you need to navigate the intricacies of healthcare policies across the United States.

Whether you're a resident looking for coverage in your home state or planning to move to another state, understanding the healthcare landscape is crucial. And hey, speaking of states, did you know each state in the U.S. has its own unique quirks? For instance, did you know that Alabama is the only state to have an alcoholic beverage as its official state drink? Now, let's dive into the world of healthcare policies.

Understanding the Complexities of Health Insurance

Overview of Different Health Insurance Plans

Health insurance in the United States comes in various shapes and sizes. From private insurance plans to government-sponsored programs like Medicaid and Medicare, the options can be dizzying. Let's break down the most common types:

- Private Insurance: Offered by private companies, these plans often provide comprehensive coverage but can be expensive.

- Employer-Sponsored Insurance: Many people get their insurance through their workplace. These plans are generally more affordable but may have limited options.

- Medicaid: A state and federal program that provides health coverage for low-income individuals and families.

- Medicare: A federal program that offers health coverage for individuals aged 65 and older.

Medicaid and Medicare: Eligibility and Coverage

Medicaid and Medicare are government-sponsored programs designed to provide health coverage for specific groups. Medicaid primarily serves low-income individuals, while Medicare is for those 65 and older. Eligibility criteria and coverage can vary by state, so it's essential to check your state's specific guidelines.

Insurance Exchanges and Marketplace Options

Insurance exchanges, often referred to as "the marketplace," are platforms where you can compare and purchase health insurance plans. These exchanges are either state-run or federally managed and offer a range of options to fit various needs and budgets.

Navigating Healthcare Policies by State

State-Specific Regulations and Coverage Options

Healthcare policies can vary significantly from one state to another. Some states have expanded Medicaid under the Affordable Care Act, while others have not. Additionally, the types of private insurance plans available may differ based on state regulations.

| State | Medicaid Expansion | Notable Private Insurance Providers |

|---|---|---|

| California | Yes | Blue Shield, Kaiser Permanente |

| Texas | No | Blue Cross Blue Shield, Aetna |

| New York | Yes | EmblemHealth, Fidelis Care |

Key Considerations for Out-of-State Coverage

If you're planning to move to another state or require medical services in a different state, it's crucial to understand how your coverage will work. Some plans offer nationwide coverage, while others might limit you to in-network providers in your home state.

- Network Restrictions: Check if your plan has network restrictions that limit out-of-state coverage.

- Emergency Services: Most plans will cover emergency services at any hospital, but non-emergency services might not be covered.

- Telehealth Options: Some plans offer telehealth services that can be accessed from any state.

Essential Services and Coverage Decisions

What Services are Covered by Health Insurance?

Health insurance plans generally cover a range of essential services, from preventive care to emergency services. However, the extent of coverage can vary depending on the plan and provider. For a comprehensive list of what's generally covered, you can visit the HealthCare.gov website.

Understanding Co-pays, Deductibles, and Premiums

When it comes to health insurance, terms like co-pays, deductibles, and premiums can be confusing. Here's a quick breakdown:

- Co-pay: A fixed amount you pay for a covered healthcare service.

- Deductible: The amount you owe for healthcare services before your insurance plan starts to pay.

- Premium: The amount you pay for your health insurance every month.

For more information on these terms, the Agency for Healthcare Research and Quality offers a useful guide.

Recent Changes and Impacts of the Affordable Care Act

The Affordable Care Act (ACA), commonly known as Obamacare, has had a significant impact on healthcare policies and insurance coverage in the United States. Since its enactment in 2010, the ACA has expanded Medicaid, created health insurance marketplaces, and implemented a variety of consumer protections.

Expansion of Medicaid

One of the most notable changes brought about by the ACA is the expansion of Medicaid to include more low-income adults. However, not all states have adopted this expansion. For a current list of states that have expanded Medicaid, you can visit the Kaiser Family Foundation website.

Consumer Protections

The ACA introduced several consumer protections, including prohibiting insurance companies from denying coverage based on pre-existing conditions. For more details on these protections, the Centers for Medicare & Medicaid Services offer an informative guide.

Comparing and Choosing the Right Health Insurance Plan

Factors to Consider when Selecting a Plan

Selecting the right health insurance plan is a crucial decision that requires careful consideration. Here are some factors to keep in mind:

- Cost: Consider the premiums, deductibles, and co-pays.

- Coverage: Make sure the plan covers the services you need.

- Network: Check if your preferred healthcare providers are in-network.

- Additional Benefits: Look for plans that offer extra services like mental health support or wellness programs.

For a more in-depth guide on selecting a plan, you can visit HealthCare.gov.

Tips for Evaluating Coverage and Provider Networks

When evaluating plans, it's essential to look at the provider network. Some plans offer a broad network, while others are more limited. Make sure to check whether your preferred doctors and hospitals are in-network. For tips on how to evaluate provider networks, the Agency for Healthcare Research and Quality has a useful guide.

Resources for Assistance and Information

Finding the right healthcare plan and understanding policies can be a daunting task, but you don't have to go it alone. There are numerous resources available to help you navigate the complexities of healthcare in the United States.

Government Resources

The government provides several resources to help you understand healthcare policies and make informed decisions. Websites like HealthCare.gov and Centers for Medicare & Medicaid Services offer a wealth of information.

Non-Profit Organizations

Several non-profit organizations offer guidance and assistance in navigating healthcare policies. Organizations like the Kaiser Family Foundation and the Agency for Healthcare Research and Quality provide valuable insights and tools.

Private Consultation Services

If you prefer personalized guidance, many private consultation services can help you understand your options and make the best decisions for your healthcare needs.

FAQs (Frequently Asked Questions)

What are the different types of health insurance plans available in the United States?

There are several types of health insurance plans in the U.S., including private insurance, employer-sponsored insurance, Medicaid, and Medicare. For more details, refer to the section on Understanding the Complexities of Health Insurance.

How do Medicaid and Medicare differ in terms of eligibility and coverage?

Medicaid is primarily for low-income individuals and families, while Medicare is for those aged 65 and older. Eligibility and coverage can vary by state. For more information, visit the Centers for Medicare & Medicaid Services.

What should I consider when comparing health insurance plans?

When comparing plans, consider factors like cost, coverage, and network restrictions. For a comprehensive guide, you can visit HealthCare.gov.

Where can I find resources and assistance for navigating healthcare policies?

Resources are available from government websites, non-profit organizations, and private consultation services. For a detailed list, refer to the section on Resources for Assistance and Information.